Division 974 Debt Test

1 A scheme satisfies the debt test in this subsection in relation to an entity if. This guide outlines the broad operation of the debtequity rules in Division 974 of the Income Tax Assessment Act 1997.

Https Www2 Deloitte Com Content Dam Deloitte Au Documents Tax Tax 20insights 20 2018 20 20ato 20rules 20that 20transfer 20pricing 20provisions 20override 20debt Equity 20rules Pdf

It explains when the debtequity measures contained in Division 974 of the Income Tax Assessment Act 1997 - the debtequity rules - apply to at call loans made to a company by a.

Division 974 debt test. Schedule 1 item 34 subsection 974-201 2151 The focus of the debt test on the effectively non-contingent obligations of the issuer rather than on the ability of the investors to recover their investment is consistent with accounting standards and the regulatory regime for Australian ADIs. A the scheme is a financing arrangement for the entity. Debt and equity rules in Division 974.

The tests in Division 974 determine whether a scheme that is a financing arrangement gives rise to a debt interest or an equity interest. A gives rise to a debt interest. The debtequity rules determine whether an interest is a debt interest or an equity interest.

1 An object of this Division is to establish a test for determining for particular tax purposes whether a scheme or the combined operation of a number of schemes. The debtequity rules of Division 974 of the Income Tax Assessment Act 19971that a lot of the issues would have been ironed out. A non-share equity interest could be a loan with no interest that fails to pass the debt test under Division 974 of the ITAA 1997 but Division 245 would still apply if the interest could have been deductible due for the operation of section 245-15 of ITAA 1997 which relates to non-share distributions and dividends.

Section 974-80 of Australias Income Tax Assessment Act 1997 Cth was intended to apply where returns on equity instruments were funded by interest from interposed debt instruments. The test is designed to assess the economic substance of an interest in terms of its impact on the issuers position. A to establish a test for determining for particular tax purposes whether a scheme or the combined operation of a number of schemes gives rise to a debt interest or an equity interest.

A the scheme would satisfy paragraphs 974-20 1 b and c. This guide is designed for tax professionals as well as controlling shareholders directors and other connected entities of companies who lend money at call to a company. INCOME TAX ASSESSMENT ACT 1997 - SECT 9745.

The potential application of the section 974-80 integrity rule must be constrained so that it would apply only in the narrow circumstances that it was included in the law to address particular circumstances where an instrument that satisfies the debt test is used to fund an effective equity interest held by an ultimate investor. A financing arrangement is identified Division 974 provides both a debt test and an equity test to determine its characterisation. Determining whether a payment relating to an interest may be deductible or frankable the dividend and interest withholding tax rules and.

Income tax assessment act 1997 - sect 9741 What this Division is about This Division tells you whether an interest is a debt interest or an equity interest for tax purposes. INCOME TAX ASSESSMENT ACT 1997 - SECT 97420. The test for a debt interest.

The guide is divided into two parts. Guide to at call loans. Under section 974-80 the interposed debt instrument would be deemed to be equity for income tax purposes and any return on the instrument would be nondeductible.

Test for distinguishing debt and equity interests. 31 Objects of Division 974 The stated objects of Division 974 are. This is relevant to.

974-65 Commissioners power 1 Despite subsection 974-20 1 the debt test the Commissioner may determine that a scheme gives rise to a debt interest in an entity if the Commissioner considers that. 1 The test for distinguishing between debt interests and equity interests focuses on economic substance rather than mere legal form see subsection 974-10 2. B that the test operates on the basis of economic substance rather than on the basis.

The debt test takes priority in the event that both tests are satisfied4. The test is used for example for. If neither of the tests are satisfied.

Debt and equity tests. Satisfying the debt test. INCOME TAX ASSESSMENT ACT 1997 - SECT 97410.

B gives rise to an equity interest. Further the grandfathering of pre-existing arrangements ceased 30 June 2004 and therefore the new rules effectively apply to all financial arrangements. B the entity or a connected entity of the entity receives or will receive a financial benefit or benefits under the scheme.

Accordingly in practice the debt test is applied first. Guide to the debt and equity tests.

Unreal Transfer Pricing Does Not Solve Very Real Debt Equity Issues Greenwoods Herbert Smith Freehills

Https Www Hbs Edu Faculty Publication 20files Leverage 20and 20the 20beta 20anomaly 375b0691 6579 47d3 8184 01147bc726ce Pdf

424b4 1 Nt10000802x12 424b4 Htm 424b4 Table

Http Thekeep Eiu Edu Cgi Viewcontent Cgi Article 2389 Context Theses

Https Www Ato Gov Au Law View Pdf Cog Pcg2019 D003 Pdf

Optimizing Pension Outcomes Using Target Driven Investment Strategies Evidence From Three Asian Countries With The Highest Old Age Dependency Ratio Bai 2020 Asia Pacific Journal Of Financial Studies Wiley Online Library

Https Www Ato Gov Au Law View Pdf Cog Pcg2019 D003 Pdf

Https Www Ibfd Org Sites Ibfd Org Files Content Pdf 14 034 Transfer Pricing Intra Group Financing Final Web Pdf

Ato Releases Final Guidance On The Interaction Between The Transfer Pricing Rules And Debt Equity Tests Transfer Pricing Times July 2019 Duff Phelps

Ato Releases Final Guidance On The Interaction Between The Transfer Pricing Rules And Debt Equity Tests Transfer Pricing Times July 2019 Duff Phelps

Https Www2 Deloitte Com Content Dam Deloitte Au Documents Tax Deloitte Au Tax Insights Financing Decisions 251119 Pdf

Https Www Ato Gov Au Law View Pdf Cog Pcg2019 D003 Pdf

Unreal Transfer Pricing Does Not Solve Very Real Debt Equity Issues Greenwoods Herbert Smith Freehills

Https Www2 Deloitte Com Content Dam Deloitte Au Documents Tax Deloitte Au Tax Insights Financing Decisions 251119 Pdf

Ato Releases Final Guidance On The Interaction Between The Transfer Pricing Rules And Debt Equity Tests Transfer Pricing Times July 2019 Duff Phelps

Https Www Ibfd Org Sites Ibfd Org Files Content Pdf Tpig Sample Pdf

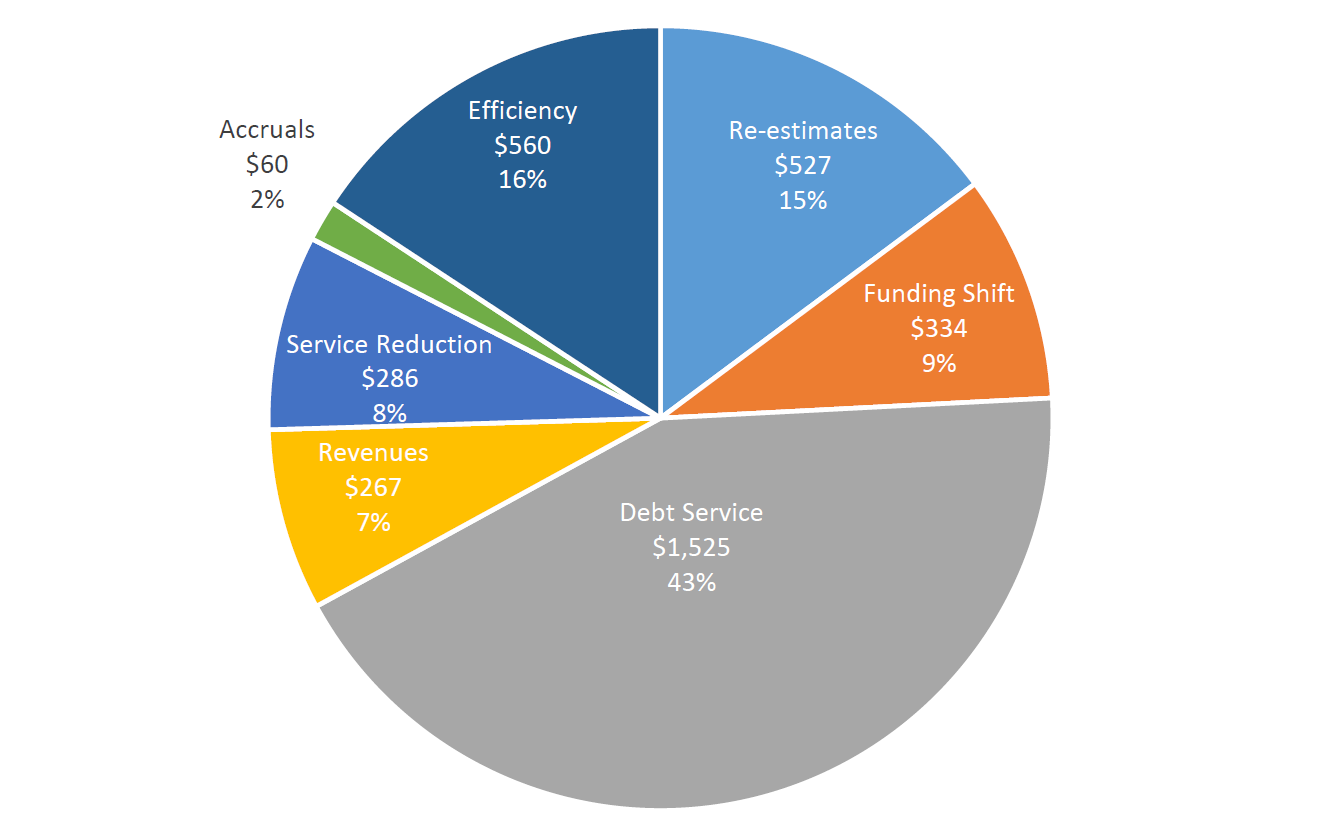

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Https Www Pwc Com Au Tax Taxtalk Assets Monthly Pdf Corporate Tax Update Apr14 Pdf

Https Www2 Deloitte Com Content Dam Deloitte Au Documents Tax Tax 20insights 20 2018 20 20ato 20rules 20that 20transfer 20pricing 20provisions 20override 20debt Equity 20rules Pdf